springfield mo sales tax on food

The springfield missouri sales tax rate of 81 applies to the following thirteen zip codes. The County sales tax.

Missouri Sales Tax Rate Rates Calculator Avalara

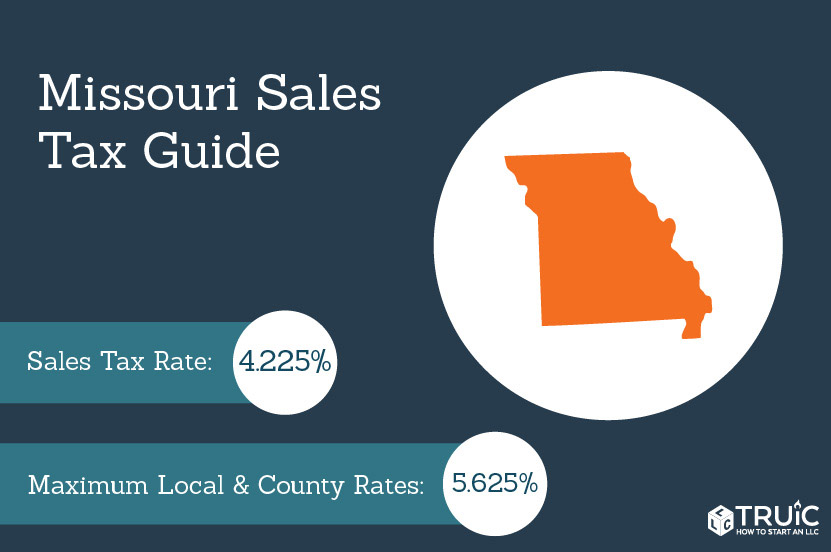

The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

. What is the sales tax rate in the City of Springfield. There is no applicable special tax. Sales Tax State Local Sales Tax on Food.

The rate for food sales was reduced by 3 from 4225 to 1225. Missouri has recent rate changes Wed Jul 01 2020. This is the total of state county and city sales tax rates.

You can print a. The Missouri sales tax rate is currently. Real property tax on median home.

With local taxes the total sales tax rate is between 4225 and 10350. If your business activity involves operating a food establishment proof of a healthfood permit is required prior to issuing the license. The state sales tax rate in Missouri is 4225.

This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. It is tied to the food stamp program because federal law prohibits any sales tax on purchases made with benefits and grocery computers were programmed to exclude those. The 3 reduction applies to all types of food items that may be purchased with Food Stamps click here for more.

The December 2020 total local sales tax rate was also 8100. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. Tax On Food.

The minimum combined 2022 sales tax rate for Springfield Missouri is. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and. Sales Taxes Amount Rate Springfield MO.

The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. Sales tax state local sales tax on food. Springfield Mo Sales Tax On Food.

The base sales tax rate is 81. Springfield in Missouri has a tax rate of 76 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Springfield totaling 337. Missouri Retail Sales Tax License.

Counties and cities can charge an additional local sales tax of up to 5125 for a.

![]()

Local Food Waste Summit Learn More And Register

Costco Opens In Springfield Mo

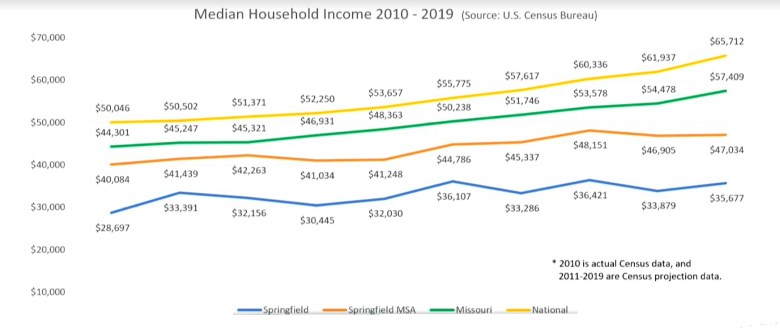

Taxes Springfield Regional Economic Partnership

Will Missouri Start Taxing Online Purchases From Out Of State Sellers

Friend S Karaoke Pub In Springfield Mo Menu

Expert Advice For Moving To Springfield Mo 2022 Relocation Guide

Missouri Man Pranks Kum Go With Fake Ad And Now They Re Really Selling His Meal Kamr Myhighplains Com

Sales Taxes In The United States Wikipedia

1270 N New Castle Ave Springfield Mo 65802 Realtor Com

Despite High Sales Tax Revenue Springfield Preps For Inflation Fueled Slowdown Springfield Daily Citizen

Despite High Sales Tax Revenue Springfield Preps For Inflation Fueled Slowdown Springfield Daily Citizen

.png.jpg)

Buc Ee S Targets Springfield For First Missouri Store Springfield Business Journal

What Do Springfield Residents Pay In Sales Tax

Missouri Sales Tax Small Business Guide Truic

Missouri Income Tax Calculator Smartasset

Missouri Partnership Economic Development Location Low Business Costs

Missouri Governor Proposes Special Session To Cut Taxes After Vetoing Rebate Plan Missouri Independent

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Small Restaurant Business For Sale In Springfield Missouri Bizbuysell